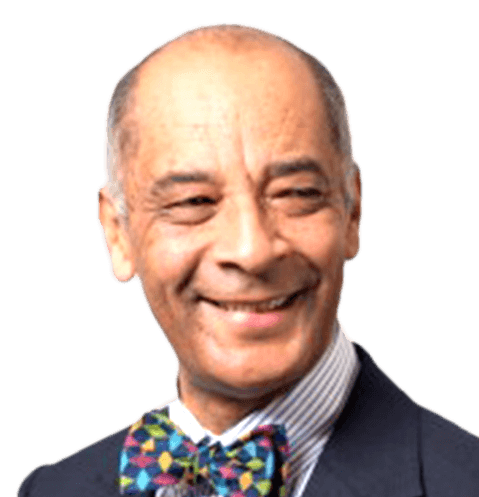

Mukesh is an external consultant partly responsible for the financial audit process across all pharmacies. Mukesh works closely with a top 6 accountancy firm which will annually be auditing all Alitam pharmacies. He is known amongst his peers for his extreme professionalism, high financial technical skills and the experience he brings to the projects he undertakes.

Mukesh is an Equity Director of Robinson Sterling, a dynamic and forward-thinking firm of Chartered Accountants based in East London. The firm has become part of the record breaking overnight merger of 122 independent professional firms known as the Xeinadin Group. Mukesh is experienced in audit services and has already made a major impact in his work with the Board of Directors.

Born in Nairobi, Kenya, Mukesh moved to the UK in the early 1970s with his family, following the overseas transfer of his father within the newly created International division of Barclays Bank.

Having trained with a six partner firm of Chartered Accountants in central London, Mukesh qualified as an ACCA in 1988 and managed a portfolio of prestigious, high net-worth clients with Littlejohn Frazer, a panel firm of auditors for Lloyds of London.

Mukesh started his own practice in 1990 and handled key family-owned building supplies and transport businesses in East London. In addition to handling his own practice clients, Mukesh also undertook specialist consultancy projects. These included business development reviews and advising other firms in the setup of their professional training and regulatory systems.

In 1994, Mukesh was recruited by Arthur Andersen and posted to Nairobi to manage the merger of a local firm into the Arthur Andersen Worldwide Organisation, dealing with key multinational clients in the East African region. In addition to the integration, Mukesh also managed the audit and reporting requirements of major financial services institutions and other key manufacturing clients in the region.

In 1996, Mukesh was recruited by the Sameer Group, one of East Africa’s largest conglomerates. Its portfolio comprised a wide variety of major brands operating in East Africa, including Firestone Tyres, Eveready Batteries, Isuzu Motor Vehicles and Sasini Tea and Coffee Limited, a plantation company quoted on the Nairobi Stock Exchange.

Mukesh headed the Group finance function at Sasini, and oversaw the Group’s audit and corporate reporting requirements for the Nairobi Stock Exchange. He also set up the Group’s private trading and export division in the port of Mombasa, and managed key relationships with companies including Kraft Heinz, Unilever and Tetley.

Having spent over 11 years in East Africa, Mukesh returned to the UK in 2005. He joined United Biscuits as an independent consultant, leading a specialist team responsible for the business insurance claim following the floods of 2005. Working closely with the forensic accountants from KPMG, and the loss adjusters, Mukesh and his team successfully negotiated a £68m settlement with the insurers, Allianz.

Mukesh returned to professional practice in October 2006 by acquiring a 50% equity share in Robinson Sterling. In his current role as Equity Director, Mukesh handles over 200 clients, including family-owned SMEs and UK based branches of overseas companies.

He has recently been involved in formulating business plans and undertaking pre-lend financial due diligence for major clients requiring business interruption loan finance.

In addition to his business development and strategic planning skills, Mukesh has a strong professional network in the City of London. He has already introduced leading corporate finance professionals to the Alitam Group as the group plans for significant growth and development.